Navigating the Future: Real Estate Pricing Trends in 2025

Navigating the Future: Real Estate Pricing Trends in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Future: Real Estate Pricing Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Navigating the Future: Real Estate Pricing Trends in 2025

- 2 Introduction

- 3 Navigating the Future: Real Estate Pricing Trends in 2025

- 3.1 Key Drivers of Real Estate Pricing Trends in 2025

- 3.2 Potential Real Estate Pricing Trends in 2025

- 3.3 Related Searches

- 3.4 FAQs about Real Estate Pricing Trends in 2025

- 3.5 Tips for Navigating Real Estate Pricing Trends in 2025

- 3.6 Conclusion

- 4 Closure

Navigating the Future: Real Estate Pricing Trends in 2025

The real estate market is a dynamic entity, constantly evolving under the influence of economic shifts, demographic changes, and technological advancements. Predicting the future of real estate pricing is an intricate endeavor, requiring careful analysis of current trends and potential future catalysts. While definitive predictions are impossible, understanding the key drivers shaping the market can provide valuable insights into potential real estate pricing trends in 2025.

Key Drivers of Real Estate Pricing Trends in 2025

Several factors will likely play a significant role in shaping real estate pricing trends in 2025:

1. Economic Conditions:

- Interest Rates: The Federal Reserve’s monetary policy will heavily influence mortgage rates, impacting affordability and demand. Higher interest rates tend to cool down the market, while lower rates stimulate buying activity.

- Inflation: Persistent inflation erodes purchasing power, potentially leading to price adjustments in the real estate market.

- Economic Growth: A robust economy generally translates to higher employment and income levels, boosting demand for housing. Conversely, economic downturns can lead to market stagnation or even price declines.

2. Demographic Shifts:

- Aging Population: As the Baby Boomer generation continues to age, demand for age-appropriate housing, such as retirement communities and smaller, more accessible homes, is expected to rise.

- Millennial Homeownership: Millennials are a large and influential demographic group entering their prime homebuying years. Their preferences for urban living, walkability, and sustainable features will shape housing demand in specific areas.

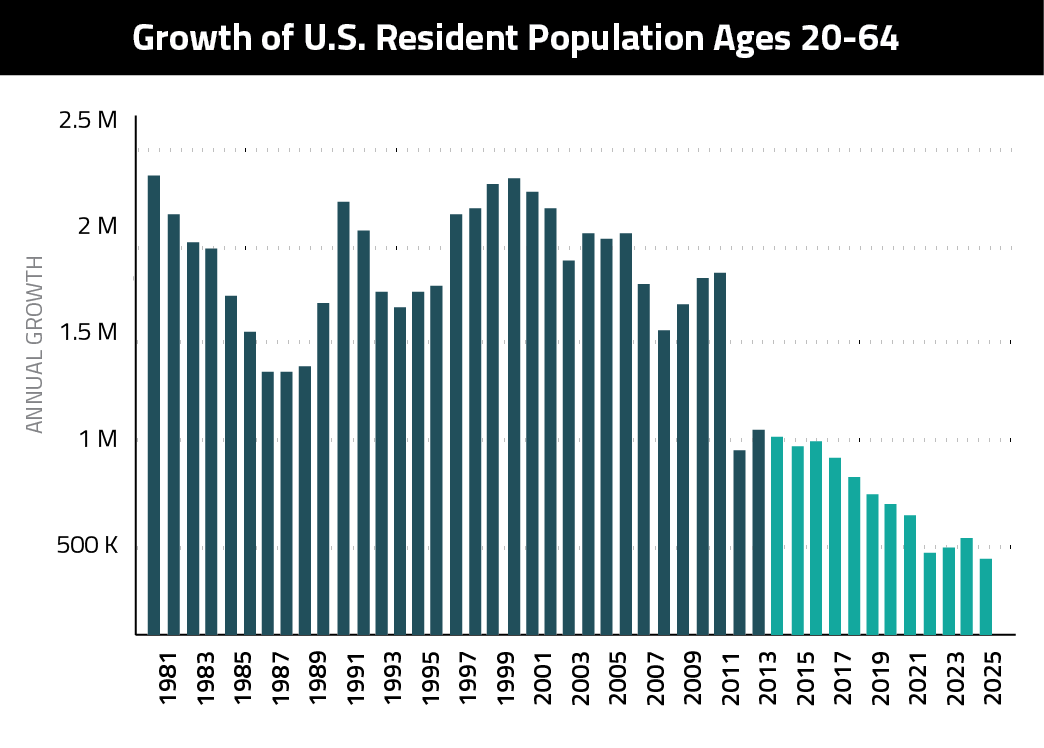

- Immigration and Urbanization: Migration patterns, both domestic and international, will continue to influence housing demand in particular regions. Urbanization trends will likely drive up prices in major metropolitan areas.

3. Technological Advancements:

- Remote Work: The rise of remote work has already begun to shift housing preferences, with many seeking more affordable options outside major cities. This trend could continue to reshape the real estate landscape.

- Smart Homes and Sustainable Technologies: The integration of smart home features and sustainable technologies is becoming increasingly popular, potentially influencing property values.

- PropTech Innovations: Emerging technologies in real estate, including blockchain and artificial intelligence, could disrupt traditional practices and impact pricing strategies.

4. Government Policies and Regulations:

- Tax Incentives and Regulations: Government policies related to homeownership, such as tax breaks or zoning regulations, can significantly impact affordability and market dynamics.

- Infrastructure Investments: Public investments in transportation, utilities, and other infrastructure can enhance the desirability of certain areas, potentially driving up prices.

5. Environmental Factors:

- Climate Change: Rising sea levels, extreme weather events, and other climate-related concerns could influence real estate values in vulnerable areas.

- Sustainability and Energy Efficiency: Growing environmental awareness may lead to a premium placed on energy-efficient and sustainable homes.

Potential Real Estate Pricing Trends in 2025

Given the complex interplay of these drivers, it is difficult to predict specific price movements. However, based on current trends and expert analysis, several potential real estate pricing trends in 2025 can be identified:

1. Regional Differentiation:

- Continued Growth in High-Demand Areas: Major metropolitan areas with robust job markets and desirable amenities will likely continue to experience strong price growth, driven by high demand from millennials and other groups seeking urban living.

- Shifting Demand in Suburban and Rural Areas: The rise of remote work and the desire for more affordable living could lead to increased demand in suburban and rural areas, potentially driving up prices in these regions.

- Potential Price Corrections in Overheated Markets: Some markets that experienced significant price increases in recent years may experience corrections or slowdowns in 2025, as affordability challenges and rising interest rates impact buyer demand.

2. Housing Type Preferences:

- Increased Demand for Affordable Housing: As affordability becomes a growing concern, demand for affordable housing options, such as townhomes, condos, and smaller single-family homes, is likely to increase.

- Growing Popularity of Multi-Family Dwellings: Rental units and multi-family buildings are becoming more appealing, particularly in urban areas with limited space and high housing costs.

- Demand for Sustainable and Energy-Efficient Homes: Homes incorporating green building practices, solar panels, and other sustainable features are likely to command a premium in the market.

3. Impact of Technology:

- Virtual Reality and 3D Tours: Virtual reality and 3D tours are becoming increasingly common, offering buyers a more immersive and convenient way to experience properties, potentially influencing purchasing decisions.

- Data-Driven Pricing and Valuation: Advanced analytics and AI algorithms are being used to predict market trends and provide more accurate property valuations, leading to more informed pricing strategies.

4. The Importance of Location and Amenities:

- Proximity to Amenities: Access to schools, parks, public transportation, and other desirable amenities will continue to influence property values.

- Walkability and Livability: Walkable neighborhoods with a strong sense of community and access to local shops and restaurants are likely to remain highly sought after.

Related Searches

1. Real Estate Market Forecast 2025: This search explores broader market predictions, including overall price trends, inventory levels, and economic indicators.

2. Housing Market Trends 2025: This search focuses specifically on housing market trends, including supply and demand dynamics, affordability, and regional variations.

3. Real Estate Investment Opportunities 2025: This search delves into investment opportunities in the real estate market, considering potential returns, risks, and emerging trends.

4. Future of Real Estate 2025: This search examines broader long-term trends in the real estate industry, including technological advancements, demographic shifts, and sustainability concerns.

5. Real Estate Pricing Predictions 2025: This search focuses specifically on price predictions, including expected price changes in different regions and property types.

6. Housing Market Outlook 2025: This search provides a comprehensive overview of the housing market outlook, including economic factors, demographic trends, and policy implications.

7. Real Estate Bubble 2025: This search explores potential risks of a real estate bubble forming in certain markets, considering factors like overvaluation and speculation.

8. Real Estate Investing Strategies 2025: This search examines effective investment strategies for the real estate market, considering current trends and future projections.

FAQs about Real Estate Pricing Trends in 2025

1. Will real estate prices continue to rise in 2025?

It is impossible to predict with certainty whether real estate prices will rise or fall in 2025. The market is influenced by numerous factors, and price movements can vary significantly depending on location, property type, and economic conditions.

2. What factors will have the biggest impact on real estate prices in 2025?

Interest rates, inflation, economic growth, demographic shifts, and technological advancements are likely to have the most significant impact on real estate prices in 2025.

3. Is it a good time to buy real estate in 2025?

Whether or not it is a good time to buy real estate in 2025 depends on individual circumstances, financial goals, and market conditions. It is crucial to conduct thorough research, consult with a financial advisor, and make informed decisions based on your specific needs.

4. Will remote work continue to impact real estate prices in 2025?

The impact of remote work on real estate prices is likely to continue in 2025. As more people embrace flexible work arrangements, demand for housing in suburban and rural areas is expected to rise, potentially influencing price trends.

5. What are the potential risks associated with the real estate market in 2025?

Potential risks include rising interest rates, economic downturns, inflation, and potential bubbles in certain markets. It is important to be aware of these risks and make informed investment decisions.

Tips for Navigating Real Estate Pricing Trends in 2025

1. Stay Informed: Continuously monitor market trends, economic indicators, and policy changes to understand the factors influencing real estate pricing.

2. Diversify Investments: Consider diversifying your real estate portfolio by investing in different property types and locations to mitigate risks.

3. Focus on Long-Term Value: Look for properties with strong fundamentals, such as desirable locations, good infrastructure, and potential for future appreciation.

4. Consult with Experts: Seek advice from experienced real estate professionals, financial advisors, and market analysts to make informed investment decisions.

5. Be Patient and Strategic: The real estate market can be cyclical, so be patient and avoid impulsive decisions. Develop a long-term strategy and make calculated moves based on market conditions.

Conclusion

Predicting the future of real estate pricing is a complex task, but understanding the key drivers and potential trends can provide valuable insights for navigating the market. By staying informed, diversifying investments, and making strategic decisions, individuals and investors can position themselves to capitalize on opportunities and navigate the evolving real estate landscape in 2025 and beyond. Remember, the real estate market is dynamic and constantly evolving, so continuous research and adaptability are essential for success.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Real Estate Pricing Trends in 2025. We hope you find this article informative and beneficial. See you in our next article!