Navigating the Future of Homeownership: Exploring Refinance Rate Trends in 2025

Navigating the Future of Homeownership: Exploring Refinance Rate Trends in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Future of Homeownership: Exploring Refinance Rate Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Navigating the Future of Homeownership: Exploring Refinance Rate Trends in 2025

- 2 Introduction

- 3 Navigating the Future of Homeownership: Exploring Refinance Rate Trends in 2025

- 3.1 Factors Shaping Refinance Rate Trends in 2025

- 3.2 Potential Refinance Rate Scenarios in 2025

- 3.3 The Importance of Monitoring Refinance Rate Trends

- 3.4 Related Searches:

- 3.5 FAQs about Refinance Rate Trends in 2025:

- 3.6 Tips for Navigating Refinance Rate Trends in 2025:

- 3.7 Conclusion:

- 4 Closure

Navigating the Future of Homeownership: Exploring Refinance Rate Trends in 2025

The housing market is a dynamic landscape, constantly evolving with shifting economic conditions, policy changes, and consumer behavior. Understanding the future of mortgage rates is crucial for homeowners, potential buyers, and anyone seeking to navigate the complexities of the real estate market. This comprehensive analysis delves into the potential refinance rate trends in 2025, exploring the factors influencing these trends and their implications for borrowers.

Factors Shaping Refinance Rate Trends in 2025

Several key factors will likely influence refinance rate trends in 2025:

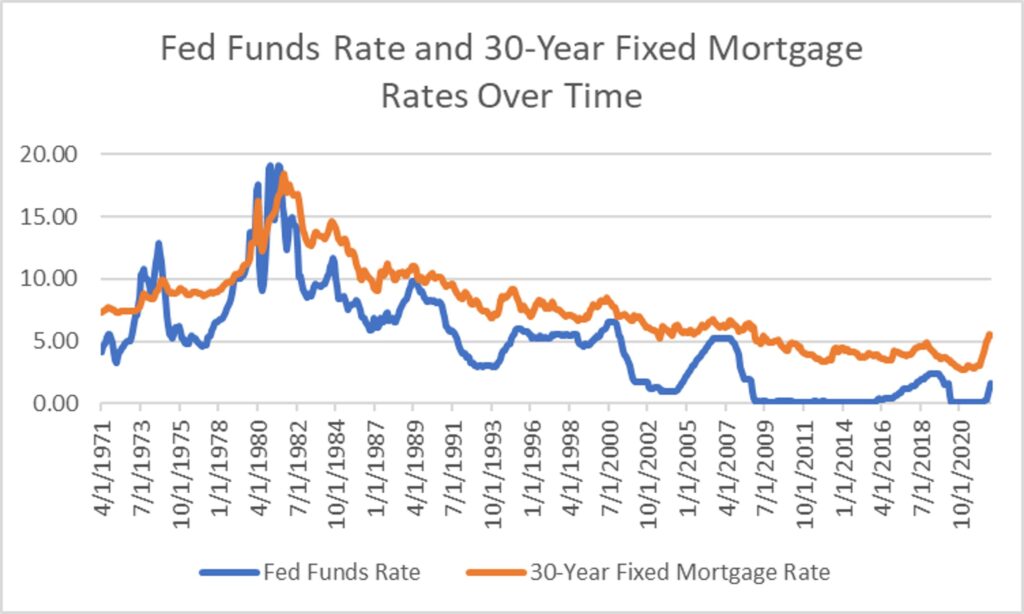

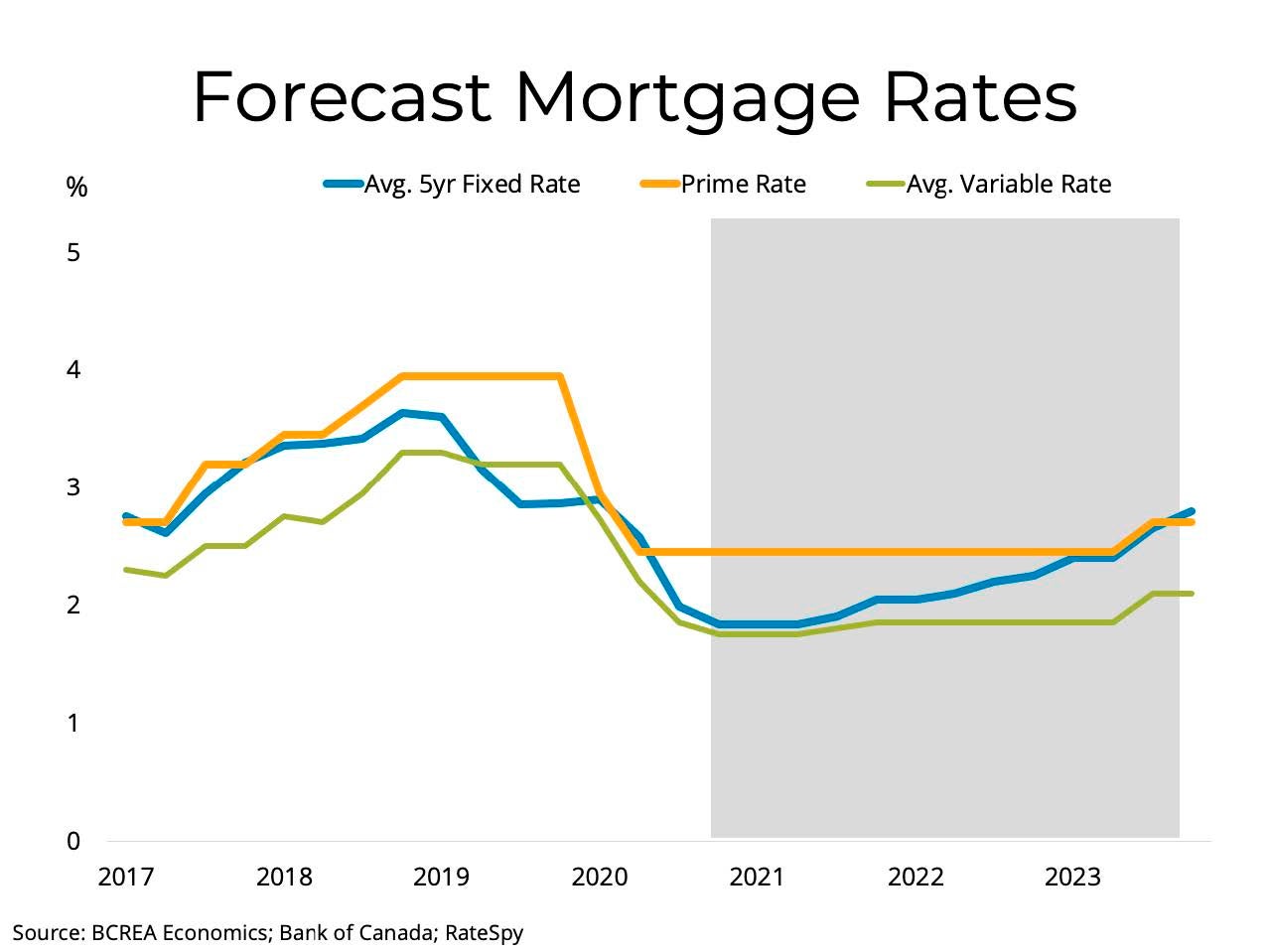

1. Federal Reserve Monetary Policy: The Federal Reserve’s actions play a pivotal role in shaping interest rates. The Fed’s target for the federal funds rate, a benchmark for borrowing costs, will directly impact mortgage rates. If the Fed continues to raise interest rates to combat inflation, mortgage rates are likely to remain elevated. Conversely, if the Fed pivots to a more accommodative stance, rates could potentially decline.

2. Inflation and Economic Growth: Inflation is a major driver of interest rate movements. When inflation is high, lenders demand higher interest rates to compensate for the erosion of their purchasing power. Conversely, low inflation can lead to lower interest rates. Economic growth also plays a role; strong economic growth typically leads to higher interest rates as investors seek higher returns.

3. Government Housing Policies: Government policies, such as those related to housing subsidies, tax breaks, and regulations, can influence refinance rate trends. Changes in these policies can impact the demand for mortgages, leading to fluctuations in rates.

4. Global Economic Conditions: The global economy’s health can also affect refinance rate trends. A global recession or financial crisis can lead to a flight to safety, pushing investors towards U.S. Treasury bonds. This increased demand for Treasuries can lower their yields, potentially leading to lower mortgage rates.

5. Market Demand and Supply: The supply and demand for mortgages also play a role in shaping rates. If the demand for mortgages is high, rates tend to rise. Conversely, low demand can lead to lower rates.

Potential Refinance Rate Scenarios in 2025

Based on these factors, several potential refinance rate scenarios for 2025 can be envisioned:

Scenario 1: Continued Rate Increases: If inflation remains high and the Fed continues its aggressive rate hike cycle, refinance rates could continue to rise in 2025. This scenario would likely make refinancing less attractive for homeowners who locked in lower rates during the recent period of historically low interest rates.

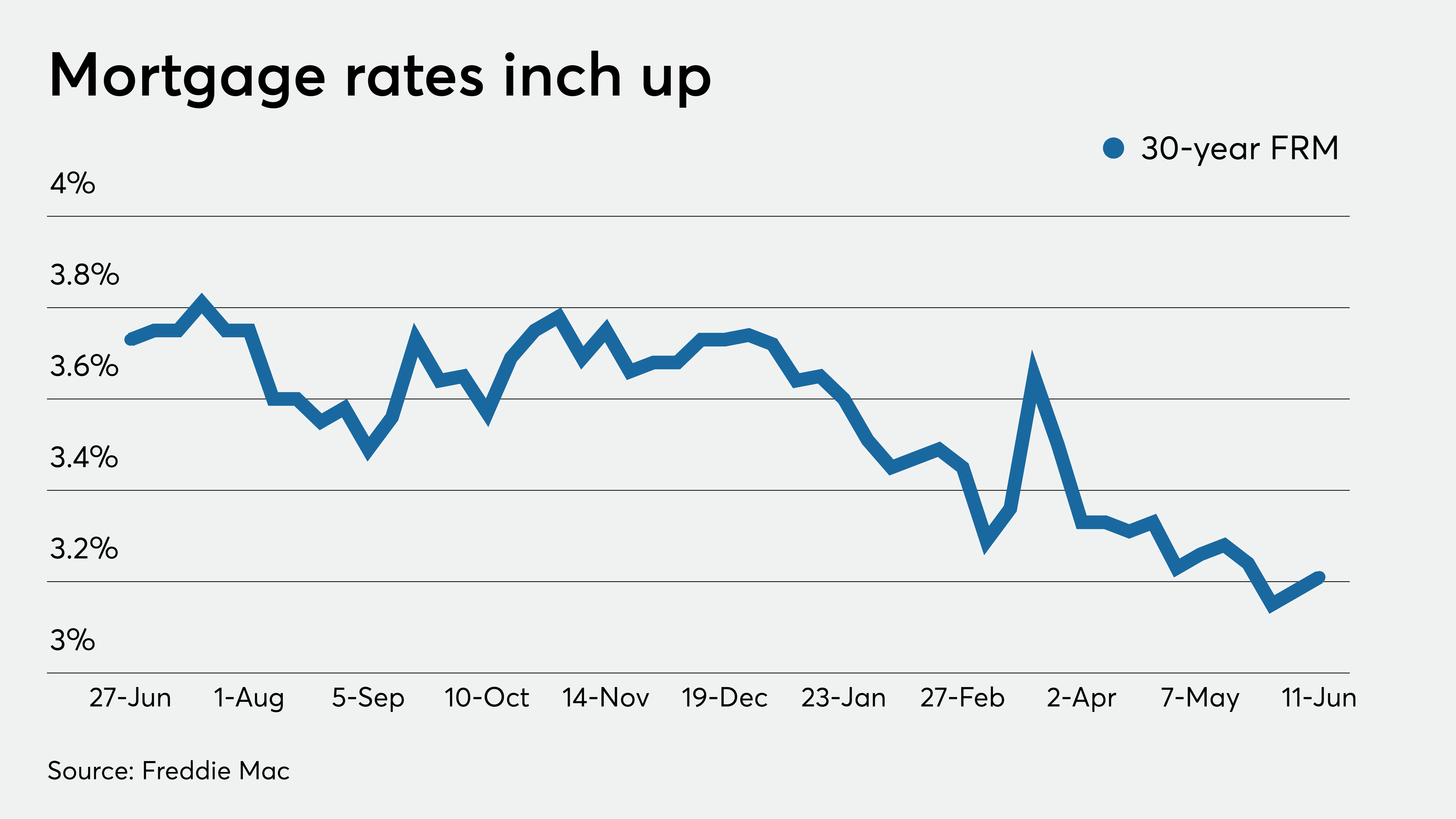

Scenario 2: Stabilization and Moderate Rates: If inflation begins to moderate and the Fed shifts to a more neutral stance, refinance rates could stabilize around current levels or experience only minor fluctuations. This scenario would offer homeowners some breathing room and potentially create opportunities for those with higher existing rates to refinance.

Scenario 3: Rate Declines: If inflation falls significantly and the Fed reverses course, refinance rates could decline in 2025. This scenario would likely lead to a surge in refinancing activity as homeowners seek to take advantage of lower rates.

The Importance of Monitoring Refinance Rate Trends

Staying informed about refinance rate trends is crucial for homeowners for several reasons:

- Strategic Refinancing: Monitoring rate trends can help homeowners identify opportunities to refinance their existing mortgages at lower rates, potentially saving them significant amounts in interest payments over the life of their loan.

- Financial Planning: Understanding the potential trajectory of refinance rates can be valuable for long-term financial planning. Homeowners can factor potential rate changes into their budgeting and investment strategies.

- Market Timing: By staying abreast of rate trends, homeowners can make more informed decisions about when to buy, sell, or refinance their properties.

Related Searches:

1. Mortgage Rates Forecast 2025: This search focuses on broader predictions for mortgage rates in 2025, encompassing both purchase and refinance rates. It provides a comprehensive overview of the market outlook, including potential rate ranges and factors influencing those predictions.

2. Average Refinance Rate 2025: This search aims to understand the expected average refinance rate in 2025. It provides insights into the typical rates borrowers can anticipate, helping them gauge the potential cost savings associated with refinancing.

3. Refinance Rates by Lender 2025: This search delves into the specific refinance rates offered by various lenders in 2025. It allows borrowers to compare rates across different institutions and identify the best options for their individual needs.

4. Best Refinance Rates 2025: This search focuses on identifying the most competitive refinance rates available in 2025. It helps borrowers find the best deals and maximize their potential savings.

5. Refinance Rate Calculator 2025: This search leads to online tools that allow borrowers to calculate potential savings by refinancing their existing mortgages. These calculators take into account factors like current loan balance, interest rate, and loan term to estimate monthly payments and total interest costs.

6. Refinance Eligibility 2025: This search focuses on determining whether borrowers qualify for a refinance in 2025. It provides information on credit score requirements, loan-to-value ratios, and other eligibility criteria.

7. Refinance Pros and Cons 2025: This search explores the benefits and drawbacks of refinancing in 2025. It helps borrowers weigh the potential savings against potential costs and risks associated with refinancing.

8. Refinance Strategies 2025: This search provides guidance on effective strategies for refinancing in 2025. It offers tips on choosing the right loan type, negotiating interest rates, and maximizing potential savings.

FAQs about Refinance Rate Trends in 2025:

1. Will refinance rates go up in 2025?

The direction of refinance rates in 2025 is uncertain and will depend on several factors, including inflation, economic growth, and the Federal Reserve’s monetary policy. While it is possible that rates could continue to rise, it is also possible that they could stabilize or even decline.

2. What factors will influence refinance rates in 2025?

Several factors will influence refinance rates in 2025, including:

- Inflation: High inflation typically leads to higher interest rates.

- Economic Growth: Strong economic growth can also lead to higher interest rates.

- Federal Reserve Policy: The Fed’s actions on interest rates directly impact mortgage rates.

- Government Housing Policies: Changes in government policies can affect mortgage demand and rates.

- Global Economic Conditions: Global economic events can influence investor behavior and affect mortgage rates.

3. When is the best time to refinance?

The best time to refinance depends on several factors, including:

- Current Interest Rates: If current rates are significantly lower than your existing mortgage rate, refinancing could save you money.

- Your Financial Situation: Ensure you meet the eligibility criteria for a refinance and can afford the new monthly payments.

- Your Long-Term Plans: Consider your long-term housing plans and whether refinancing aligns with your goals.

4. What are the risks associated with refinancing?

There are risks associated with refinancing, including:

- Closing Costs: Refinancing involves closing costs, which can eat into potential savings.

- Interest Rate Increases: If interest rates rise after you refinance, your new rate could be higher than your original rate.

- Extended Loan Term: Refinancing to a longer term can lower your monthly payments but increase the total amount of interest you pay over the life of the loan.

5. How can I find the best refinance rate?

To find the best refinance rate, you should:

- Compare Rates from Multiple Lenders: Shop around and get quotes from several lenders.

- Check Your Credit Score: A good credit score can help you qualify for lower rates.

- Consider Different Loan Types: Explore different loan options, such as fixed-rate or adjustable-rate mortgages, to find the best fit for your needs.

Tips for Navigating Refinance Rate Trends in 2025:

- Monitor Market Trends: Stay informed about refinance rate trends by regularly checking financial news sources and websites that track mortgage rates.

- Compare Lenders: Obtain quotes from multiple lenders to ensure you are getting the best possible rate.

- Shop Around for Closing Costs: Negotiate closing costs with lenders and consider using a mortgage broker to help you find the best deals.

- Consider a Fixed-Rate Mortgage: A fixed-rate mortgage offers predictable payments and protects you from rising interest rates.

- Review Your Loan Terms: Thoroughly understand the terms of your loan, including the interest rate, loan term, and any associated fees.

- Consult with a Financial Advisor: Seek professional advice from a qualified financial advisor to develop a personalized strategy for managing your mortgage and refinancing decisions.

Conclusion:

Predicting refinance rate trends with certainty is impossible due to the inherent volatility of the housing market. However, by understanding the factors influencing rates and staying informed about market developments, homeowners can make informed decisions about refinancing their mortgages. Whether rates rise, stabilize, or decline in 2025, staying proactive and strategic is key to navigating the complexities of the mortgage market and achieving your financial goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future of Homeownership: Exploring Refinance Rate Trends in 2025. We hope you find this article informative and beneficial. See you in our next article!