Navigating the Future: A Deep Dive into Real Estate Price Trends in 2025

Navigating the Future: A Deep Dive into Real Estate Price Trends in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Future: A Deep Dive into Real Estate Price Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Navigating the Future: A Deep Dive into Real Estate Price Trends in 2025

- 2 Introduction

- 3 Navigating the Future: A Deep Dive into Real Estate Price Trends in 2025

- 3.1 Understanding the Dynamics of Real Estate Price Trends

- 3.2 Exploring the Potential Landscape of Real Estate Price Trends in 2025

- 3.3 Related Searches: A Deeper Dive into Specific Market Dynamics

- 3.4 Frequently Asked Questions (FAQs) about Real Estate Price Trends in 2025

- 3.5 Tips for Navigating Real Estate Price Trends in 2025

- 3.6 Conclusion: A Glimpse into the Future of Real Estate

- 4 Closure

Navigating the Future: A Deep Dive into Real Estate Price Trends in 2025

The real estate market is a dynamic entity, constantly influenced by a multitude of factors. Predicting its future trajectory is a complex endeavor, but understanding the key drivers and emerging trends can provide valuable insights for investors, homeowners, and anyone seeking to navigate the market. This comprehensive analysis aims to illuminate the potential landscape of real estate price trends in 2025, exploring the forces shaping the market and offering a glimpse into what the future may hold.

Understanding the Dynamics of Real Estate Price Trends

Real estate price trends are influenced by a complex interplay of economic, social, and demographic factors. While predicting the future with certainty is impossible, analyzing these factors can provide a framework for understanding potential shifts in the market.

Key Drivers of Real Estate Price Trends:

- Economic Growth and Interest Rates: Economic expansion typically fuels demand for housing, leading to price increases. Conversely, economic downturns can suppress demand and lead to price declines. Interest rates play a crucial role, with lower rates making mortgages more affordable, stimulating demand and potentially driving prices up.

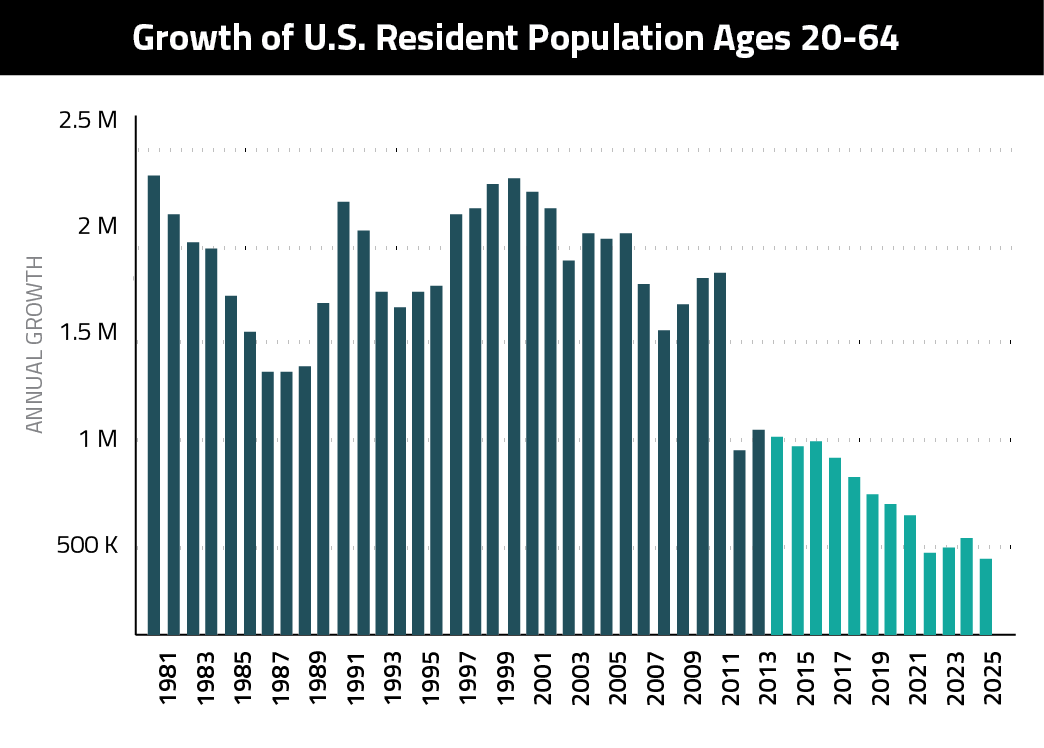

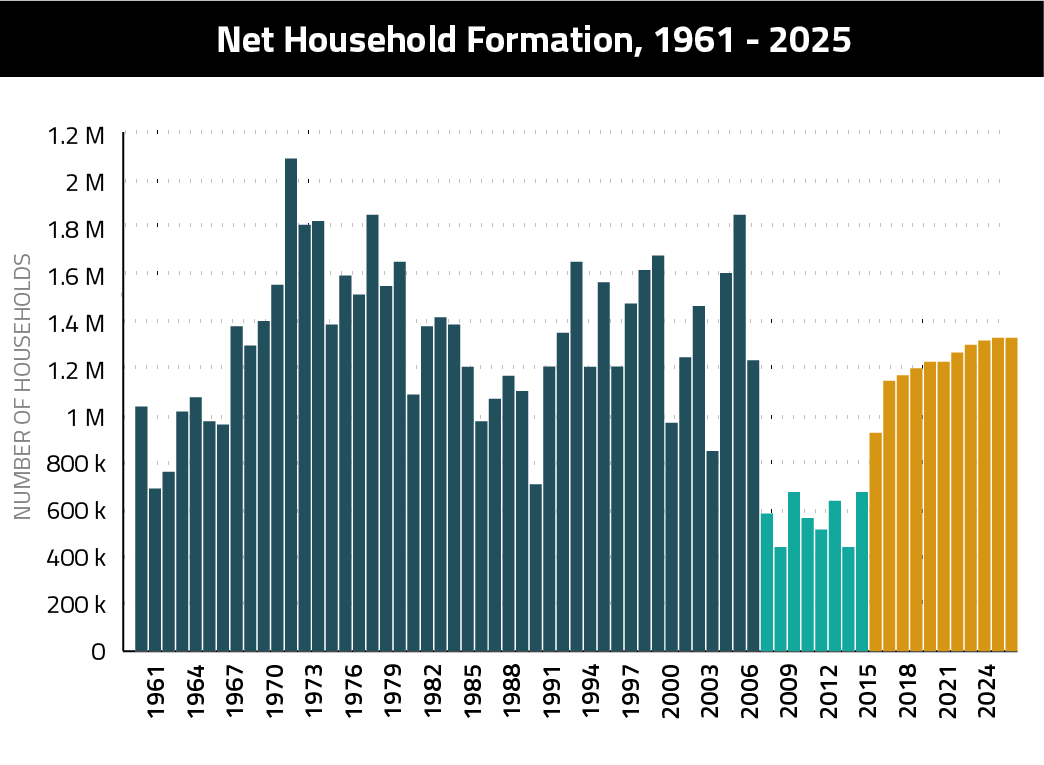

- Demographics and Population Growth: A growing population, particularly in urban areas, can create a surge in demand for housing, pushing prices upward. Shifts in demographics, such as an aging population or an increase in single-person households, can also influence housing preferences and price trends.

- Government Policies and Regulations: Government policies, including tax incentives, zoning regulations, and housing subsidies, can significantly impact real estate prices. For example, tax breaks for homebuyers can stimulate demand, while stricter zoning regulations can limit supply and potentially drive prices higher.

- Supply and Demand: The fundamental principles of supply and demand also govern real estate prices. Limited supply, coupled with strong demand, can lead to price increases. Conversely, an oversupply of housing can lead to price declines.

- Technological Advancements: Technological innovations, such as the rise of remote work and the emergence of smart homes, are influencing housing preferences and potentially shaping real estate trends.

Exploring the Potential Landscape of Real Estate Price Trends in 2025

Predicting the future of real estate prices is inherently challenging, but several factors suggest potential trends that could shape the market by 2025.

Factors Suggesting Potential Price Increases:

- Continued Economic Growth: If economic growth continues at a moderate pace, demand for housing is likely to remain strong, potentially leading to price increases.

- Limited Housing Supply: Housing supply in many urban areas remains constrained, particularly in desirable locations. This limited supply, coupled with continued demand, could lead to upward pressure on prices.

- Rising Inflation: Persistent inflation can erode the purchasing power of consumers, potentially leading to higher prices for goods and services, including housing.

- Increasing Demand for Urban Housing: With urbanization trends continuing, demand for housing in urban areas is likely to remain high, potentially pushing prices upward.

Factors Suggesting Potential Price Stability or Declines:

- Rising Interest Rates: Higher interest rates can make mortgages more expensive, potentially dampening demand for housing and leading to price stabilization or even declines.

- Economic Uncertainty: Economic uncertainty, such as potential recessions or geopolitical instability, can create market volatility and potentially lead to price declines.

- Shifting Housing Preferences: Changing housing preferences, such as a growing preference for smaller homes or a desire for more sustainable living, could impact demand and price trends.

- Technological Disruption: Technological advancements, such as the emergence of alternative housing models or increased automation in construction, could disrupt the traditional real estate market and potentially influence price trends.

Related Searches: A Deeper Dive into Specific Market Dynamics

To gain a comprehensive understanding of real estate price trends in 2025, exploring related searches can provide valuable insights into specific market dynamics.

1. Real Estate Market Forecast 2025: This search focuses on broader market predictions, including overall price trends, investment opportunities, and potential risks.

2. Housing Market Trends 2025: This search explores specific trends in the housing market, including shifts in demand, supply, and affordability.

3. Real Estate Investment Trends 2025: This search delves into investment opportunities in the real estate sector, including emerging trends, potential returns, and associated risks.

4. Real Estate Bubble 2025: This search investigates the potential for a real estate bubble, exploring factors that could contribute to a market downturn.

5. Real Estate Market Crash 2025: This search analyzes the possibility of a market crash, examining potential triggers and the potential impact on prices.

6. Real Estate Market Outlook 2025: This search provides a broader perspective on the future of the real estate market, including potential challenges and opportunities.

7. Real Estate Price Predictions 2025: This search focuses on specific price predictions for different geographic locations or property types.

8. Real Estate Trends by Location 2025: This search explores regional variations in real estate trends, considering factors such as local economic conditions, demographics, and housing supply.

Frequently Asked Questions (FAQs) about Real Estate Price Trends in 2025

1. Will real estate prices continue to rise in 2025?

It is impossible to predict with certainty whether real estate prices will continue to rise in 2025. Several factors, including economic growth, interest rates, and housing supply, will influence price trends.

2. Are we headed for a real estate bubble in 2025?

The potential for a real estate bubble in 2025 is a concern, particularly if rapid price increases are driven by speculative activity rather than fundamental economic factors.

3. What are the best real estate investments for 2025?

The best real estate investments for 2025 will depend on individual risk tolerance, investment goals, and market conditions. Factors to consider include location, property type, and potential rental income.

4. How will rising interest rates impact real estate prices in 2025?

Rising interest rates can make mortgages more expensive, potentially dampening demand for housing and leading to price stabilization or even declines.

5. What are the implications of technological advancements on real estate prices in 2025?

Technological advancements, such as the rise of remote work and the emergence of smart homes, could influence housing preferences and potentially shape real estate trends, impacting prices.

6. What are the potential risks associated with investing in real estate in 2025?

Potential risks associated with real estate investment in 2025 include economic downturns, rising interest rates, and market volatility.

7. How can I prepare for potential changes in real estate prices in 2025?

To prepare for potential changes in real estate prices in 2025, it is essential to stay informed about market trends, consider your financial situation, and develop a sound investment strategy.

8. What are the long-term implications of real estate price trends in 2025?

Long-term implications of real estate price trends in 2025 could include changes in housing affordability, shifts in investment patterns, and impacts on economic growth.

Tips for Navigating Real Estate Price Trends in 2025

- Stay Informed: Monitor market trends, economic indicators, and policy changes that could influence real estate prices.

- Develop a Sound Investment Strategy: Consider your financial goals, risk tolerance, and investment horizon when making real estate decisions.

- Diversify Your Portfolio: Spreading your investments across different property types or geographic locations can mitigate risk.

- Seek Professional Advice: Consult with a qualified real estate professional or financial advisor for personalized guidance.

- Be Patient and Strategic: Avoid making impulsive decisions based on short-term market fluctuations.

Conclusion: A Glimpse into the Future of Real Estate

Real estate price trends in 2025 are likely to be shaped by a complex interplay of economic, social, and technological factors. While predicting the future with certainty is impossible, understanding the key drivers and emerging trends can provide valuable insights for navigating the market.

By staying informed, developing a sound investment strategy, and seeking professional advice, individuals and investors can position themselves to navigate the evolving real estate landscape and capitalize on potential opportunities. The future of real estate remains uncertain, but by embracing a proactive and informed approach, individuals can make informed decisions and achieve their real estate goals.

![]()

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: A Deep Dive into Real Estate Price Trends in 2025. We hope you find this article informative and beneficial. See you in our next article!