Banking Trends 2025: Shaping the Future of Finance

Banking Trends 2025: Shaping the Future of Finance

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Banking Trends 2025: Shaping the Future of Finance. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Banking Trends 2025: Shaping the Future of Finance

The banking landscape is undergoing a rapid transformation, driven by technological advancements, evolving customer expectations, and a changing regulatory environment. As we approach 2025, several key trends are poised to reshape the industry, impacting how financial institutions operate, engage with customers, and deliver value.

1. The Rise of Open Banking and Data-Driven Insights

Open banking is at the forefront of banking innovation, empowering customers to share their financial data with third-party applications and services. This shift unlocks new possibilities for personalized financial management, enabling customers to access tailored products and services from a wider range of providers.

-

Data-driven insights: The influx of data generated by open banking presents a significant opportunity for banks to gain valuable insights into customer behavior and preferences. By leveraging advanced analytics, institutions can develop more personalized financial products and services, optimize marketing campaigns, and enhance risk management strategies.

-

Enhanced competition: Open banking fosters increased competition within the financial services industry. Traditional banks must adapt to this new environment by offering innovative solutions and leveraging data effectively to remain competitive against fintech startups and other non-traditional players.

-

Regulatory frameworks: The successful implementation of open banking hinges on robust regulatory frameworks that ensure data security, privacy, and consumer protection. Governments and regulatory bodies worldwide are actively working on establishing clear guidelines for data sharing and usage within the open banking ecosystem.

2. The Evolution of Digital Banking and Personalized Experiences

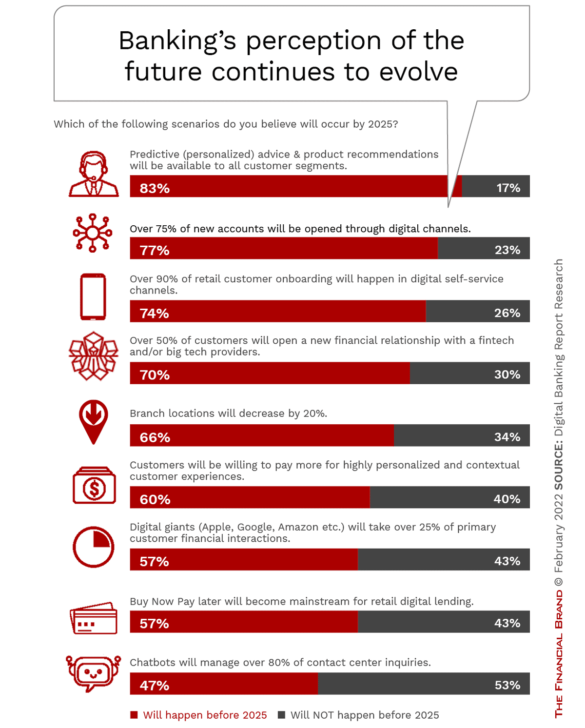

Digital banking has become the norm, with customers increasingly relying on mobile apps and online platforms for their financial needs. In 2025, the focus will shift towards enhancing the digital banking experience, offering greater personalization and seamless integration with other aspects of daily life.

-

Hyper-personalization: Banks will leverage data analytics to tailor their offerings to individual customer needs and preferences. This includes personalized recommendations for products and services, customized financial insights, and proactive support based on individual spending patterns and financial goals.

-

Seamless integration: Digital banking platforms will integrate seamlessly with other digital tools and services, such as e-commerce platforms, social media, and smart home devices. This will enable customers to manage their finances effortlessly within their existing digital ecosystems.

-

AI-powered assistance: Artificial intelligence (AI) will play a crucial role in enhancing digital banking experiences. AI-powered chatbots and virtual assistants will provide instant customer support, answer questions, and assist with transactions, creating a more efficient and user-friendly experience.

-

Voice banking: Voice-activated banking will become more prevalent, allowing customers to manage their finances hands-free through voice commands. This technology will be particularly beneficial for individuals with disabilities or those who prefer a more convenient banking experience.

3. The Growing Importance of Financial Wellness and Inclusivity

Financial wellness has gained prominence as individuals seek greater control over their finances and strive for financial stability. Banks are increasingly recognizing the importance of offering services and tools that promote financial literacy and empower customers to make informed financial decisions.

-

Financial education and planning: Banks will actively promote financial education initiatives, offering workshops, online resources, and personalized financial planning services to help customers understand their finances, set financial goals, and make sound financial decisions.

-

Financial inclusion: Banks are expanding their services to reach underserved communities, providing access to financial products and services for individuals who may have traditionally been excluded from the financial system. This includes offering mobile banking solutions, microfinance products, and financial literacy programs tailored to specific needs.

-

Digital financial tools: Banks are developing digital tools and platforms that make financial management more accessible and user-friendly. This includes budgeting apps, expense trackers, and investment platforms that empower customers to take control of their finances.

-

Mental health and financial well-being: The link between mental health and financial well-being is increasingly recognized. Banks are exploring ways to integrate mental health support services into their offerings, providing resources and guidance to customers struggling with financial stress or anxiety.

4. The Rise of Blockchain and Decentralized Finance (DeFi)

Blockchain technology has the potential to revolutionize the banking industry, offering greater transparency, security, and efficiency in financial transactions. Decentralized finance (DeFi) applications are leveraging blockchain to offer alternative financial services, such as lending, borrowing, and trading, without the need for traditional intermediaries.

-

Improved security: Blockchain’s decentralized and immutable nature makes it highly secure, reducing the risk of fraud and cyberattacks. This enhanced security can benefit both financial institutions and their customers.

-

Faster transactions: Blockchain transactions are typically processed faster than traditional financial transactions, reducing processing times and enabling real-time payments.

-

Reduced costs: By eliminating intermediaries, blockchain can reduce transaction fees and other costs associated with traditional financial services.

-

Increased transparency: Blockchain provides a transparent and auditable record of all transactions, enhancing accountability and trust within the financial system.

-

New financial products and services: DeFi applications are creating new financial products and services, such as decentralized exchanges, lending platforms, and stablecoins, offering alternatives to traditional financial institutions.

5. The Impact of Artificial Intelligence (AI) and Machine Learning

AI and machine learning are transforming the banking industry, automating tasks, improving decision-making, and enhancing customer experiences.

-

Fraud detection and prevention: AI algorithms can analyze large datasets to identify patterns and anomalies that indicate potential fraudulent activity, enabling banks to prevent financial losses and protect customer accounts.

-

Risk assessment and credit scoring: AI models can assess creditworthiness more accurately and efficiently, leading to faster and more personalized lending decisions.

-

Personalized customer service: AI-powered chatbots and virtual assistants can provide instant customer support, answer questions, and assist with transactions, creating a more efficient and user-friendly experience.

-

Automated processes: AI can automate many routine banking tasks, such as account opening, KYC verification, and loan processing, freeing up human resources for more complex and strategic activities.

-

Predictive analytics: AI models can analyze historical data to predict future trends, enabling banks to optimize their products and services and anticipate customer needs.

6. The Integration of Sustainability and Social Impact

The banking industry is increasingly embracing sustainability and social impact, aligning its operations with environmental, social, and governance (ESG) principles.

-

Sustainable investments: Banks are offering investment products that support companies and projects with strong ESG credentials, allowing customers to align their investments with their values.

-

Green loans and financing: Banks are providing financing for green projects and initiatives, such as renewable energy, sustainable infrastructure, and energy efficiency improvements.

-

Social impact banking: Banks are developing products and services that address social issues, such as financial inclusion, affordable housing, and healthcare access.

-

Environmental responsibility: Banks are reducing their own environmental footprint by adopting sustainable practices, such as using renewable energy, reducing waste, and promoting employee engagement in sustainability initiatives.

-

Transparency and reporting: Banks are increasing transparency around their ESG performance, publishing reports and data that demonstrate their commitment to sustainability and social impact.

7. The Growing Importance of Cybersecurity and Data Privacy

As the banking industry becomes increasingly digital, cybersecurity and data privacy are paramount. Banks must invest in robust security measures to protect customer data and prevent cyberattacks.

-

Multi-factor authentication: Banks are implementing multi-factor authentication (MFA) to enhance account security, requiring users to provide multiple forms of identification before granting access to sensitive information.

-

Advanced threat detection: Banks are using advanced threat detection systems to identify and mitigate potential cyberattacks, including malware, phishing, and ransomware.

-

Data encryption: Banks are encrypting customer data both at rest and in transit to prevent unauthorized access and data breaches.

-

Regular security audits: Banks are conducting regular security audits to identify vulnerabilities and ensure that their systems are secure.

-

Employee training: Banks are providing cybersecurity training to employees to raise awareness about security threats and best practices for handling sensitive information.

8. The Rise of the "Frictionless" Banking Experience

The future of banking is about creating a seamless and frictionless experience for customers. This involves simplifying processes, automating tasks, and offering personalized and intuitive solutions.

-

Biometric authentication: Banks are adopting biometric authentication methods, such as facial recognition and fingerprint scanning, to provide a more secure and convenient login experience.

-

Real-time payments: Banks are implementing real-time payment systems that enable instant transfers of funds, improving the speed and efficiency of transactions.

-

Personalized financial advice: Banks are using AI and machine learning to provide personalized financial advice and recommendations, tailoring their guidance to individual needs and goals.

-

Omni-channel banking: Banks are offering a seamless and integrated banking experience across multiple channels, including mobile apps, online platforms, branches, and call centers.

-

Customer journey optimization: Banks are focusing on optimizing the customer journey, making it easier for customers to open accounts, apply for loans, and manage their finances.

Related Searches:

-

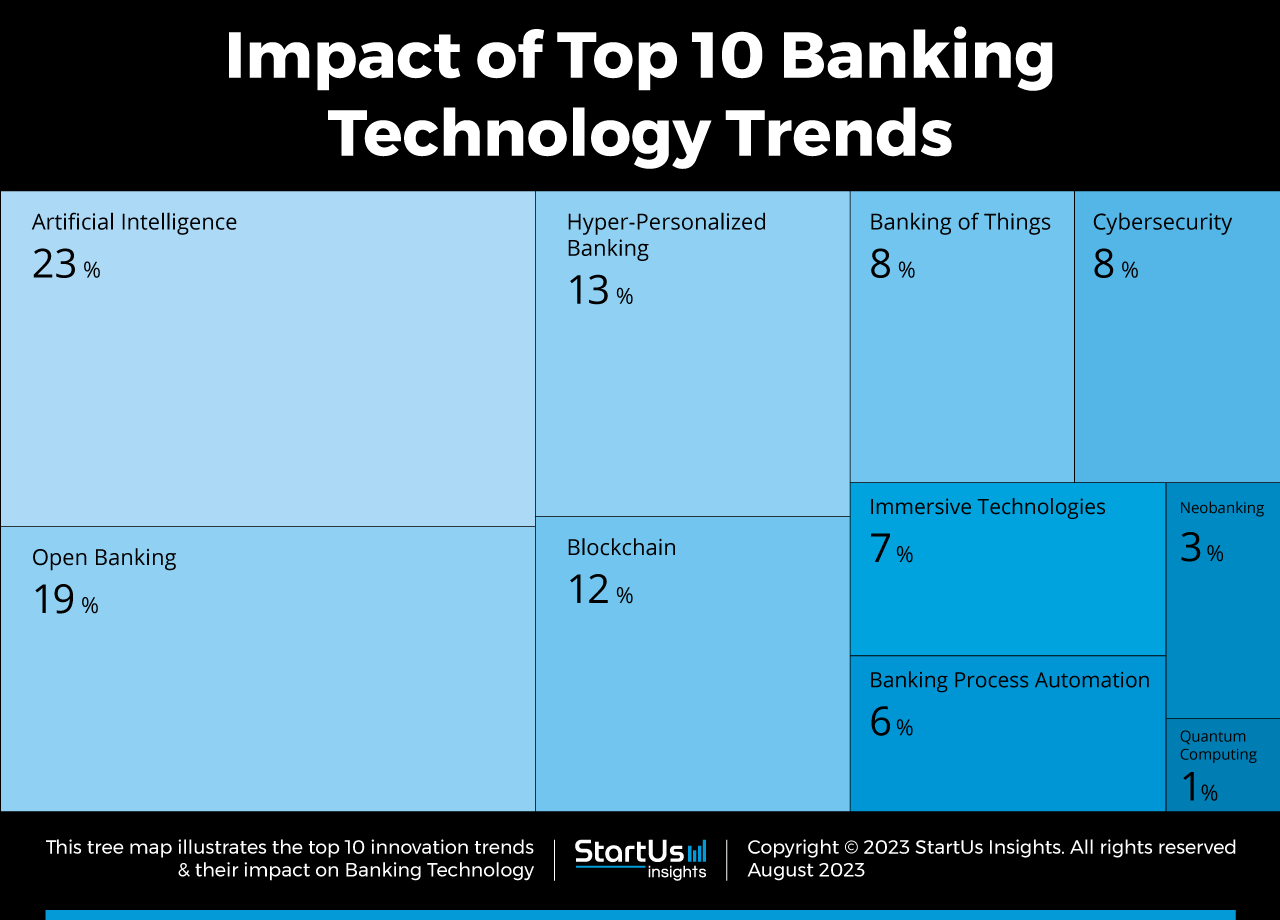

Banking Technology Trends: This encompasses the technological advancements shaping the banking industry, including open banking, AI, blockchain, and cloud computing.

-

Digital Banking Trends: This focuses on the evolution of digital banking platforms, mobile apps, and online services, highlighting trends like personalization, AI-powered assistance, and seamless integration with other digital tools.

-

Financial Technology (Fintech) Trends: This explores the impact of fintech startups and their disruptive innovations in areas like payments, lending, and wealth management.

-

Future of Banking: This examines the long-term outlook for the banking industry, considering the impact of emerging technologies, changing customer expectations, and evolving regulatory landscapes.

-

Banking Industry Trends: This provides a broad overview of the major trends impacting the banking sector, including regulatory changes, economic conditions, and geopolitical events.

-

Customer Experience in Banking: This explores how banks are improving customer experiences through personalized services, digital channels, and innovative solutions.

-

Banking Innovation: This focuses on the creative and disruptive innovations that are transforming the banking industry, including new products, services, and business models.

-

Financial Inclusion Trends: This examines the efforts to expand access to financial services for underserved populations, including initiatives to promote financial literacy, develop mobile banking solutions, and offer microfinance products.

FAQs by Banking Trends 2025

-

Q: What are the most significant technological advancements driving banking trends in 2025?

-

A: Key technological advancements shaping banking trends in 2025 include open banking, AI and machine learning, blockchain, and cloud computing. These technologies are enabling greater personalization, automation, and efficiency in financial services.

-

Q: How will open banking impact the banking industry?

-

A: Open banking will empower customers to share their financial data with third-party applications and services, leading to increased competition, personalized financial management, and data-driven insights for banks.

-

Q: What are the benefits of AI in banking?

-

A: AI can enhance fraud detection, improve risk assessment, personalize customer service, automate processes, and enable predictive analytics, leading to greater efficiency, security, and customer satisfaction.

-

Q: How can banks promote financial wellness and inclusivity?

-

A: Banks can promote financial wellness through financial education initiatives, personalized financial planning services, and digital tools for budgeting and expense tracking. They can promote inclusivity by expanding services to underserved communities and offering mobile banking solutions and microfinance products.

-

Q: What are the potential risks and challenges associated with blockchain technology in banking?

-

A: While blockchain offers numerous benefits, challenges include scalability, regulatory uncertainty, and the need for robust security measures to prevent cyberattacks.

-

Q: How can banks ensure data privacy and cybersecurity in a digital environment?

-

A: Banks must invest in robust security measures, including multi-factor authentication, advanced threat detection, data encryption, regular security audits, and employee training to protect customer data and prevent cyberattacks.

-

Q: What are the key elements of a frictionless banking experience?

-

A: A frictionless banking experience involves simplifying processes, automating tasks, offering personalized and intuitive solutions, and providing seamless integration across multiple channels.

Tips by Banking Trends 2025

-

Embrace open banking: Banks should actively participate in the open banking ecosystem, leveraging data to develop personalized products and services and create new revenue streams.

-

Invest in digital transformation: Banks must prioritize digital transformation initiatives, enhancing their digital banking platforms, mobile apps, and online services to meet evolving customer expectations.

-

Focus on financial wellness: Banks should prioritize financial wellness initiatives, offering financial education programs, personalized financial planning services, and tools to help customers manage their finances effectively.

-

Explore blockchain and DeFi: Banks should explore the potential of blockchain and DeFi, evaluating how these technologies can improve efficiency, security, and transparency in financial transactions.

-

Leverage AI and machine learning: Banks should leverage AI and machine learning to automate tasks, improve decision-making, enhance customer service, and gain valuable insights from data.

-

Prioritize sustainability and social impact: Banks should align their operations with ESG principles, offering sustainable investment products, green loans, and social impact banking initiatives.

-

Strengthen cybersecurity and data privacy: Banks must invest in robust security measures to protect customer data, prevent cyberattacks, and comply with data privacy regulations.

-

Create a frictionless banking experience: Banks should strive to create a seamless and frictionless banking experience for customers, simplifying processes, automating tasks, and offering personalized solutions.

Conclusion by Banking Trends 2025

Banking trends 2025 are poised to transform the banking industry, creating new opportunities and challenges for financial institutions. By embracing innovation, adapting to evolving customer expectations, and prioritizing sustainability and social impact, banks can navigate these trends effectively and position themselves for long-term success. The future of banking lies in harnessing technology, fostering financial well-being, and delivering a seamless and personalized customer experience.

Closure

Thus, we hope this article has provided valuable insights into Banking Trends 2025: Shaping the Future of Finance. We appreciate your attention to our article. See you in our next article!